| | | Voters now frightened of mad crazy Labor |  |

| | | Author | Message |

|---|

Veritas

Posts : 572

Join date : 2018-07-17

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Thu 24 Jan 2019, 2:45 pm Thu 24 Jan 2019, 2:45 pm | |

| - Patriot wrote:

- But you don't know what the grasping greedy unions have planned once they get your money do you ?

I know what they do with it now. Unlike YOU apparently I don't see Unions as evil.... I just want them out of politics. | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Thu 24 Jan 2019, 1:58 pm Thu 24 Jan 2019, 1:58 pm | |

| Already Labor's planned socialist destruction of Australia is coming apart at the seams. Then Labor's union brown nosers are not known for their ability to manage the economy - just look at the mess they made last time.

Labor’s negative gearing policies are flawed: Doug Driscoll

DOUGLAS DRISCOLL | 11 OCTOBER 2018

Labor’s negative gearing plans will disadvantage some first-home buyers and lower-income Aussies who are property investors working hard to get ahead.

A more effective policy would be to means-test investor tax subsidies, and cap the number of properties that can be negatively geared.

Labor’s plans to limit negative gearing to new housing and halving the capital gains tax concession will do little to help this hardworking market segment.

Labor has wrongly suggested that all investors are higher-income earners. Through the Starr Partners network of 31 real estate offices, he has learned that many investors are also first home buyers and lower-income Aussies.

I’m hearing from agents and brokers across markets popular with first home buyers, that approximately 30-35 per cent are rentvesting.

They are often purchasing a property, living in it for six to 12 months, then putting it on the rental market.

Labor is trying to help middle- and working-class families, but let’s not forget that many nurses, teachers, and policemen are also purchasing investment properties – they make up the investor profile, too. The Opposition’s proposed policy could inadvertently disadvantage many of the people it is trying to help.

To make the Australian dream of purchasing a home true for all Australians, there are more effective strategies that would appease investors and nurture first home buyers. From what I can tell, this policy is a regurgitation of Labor’s previous election manifesto.

What puzzles me most is that if it didn’t curry favour in the lead up to the last election when investors made up the majority of the market, then how is it going to garner support now that their numbers have decreased considerably. House prices are cooling, which shows the government’s macroprudential measures are working, but I agree more could still be done.

Instead of limiting negative gearing, as Labor has suggested, Aussies that want to claim tax subsidies could be means tested. This would ensure that higher-income earners are not benefitting the most, and tip the balance in favour of those that need the subsidies the most. Alternatively, capping the volume of properties an investor can negatively gear will reduce the number of negatively geared properties, without limiting it to a subset of homes.

Any existing properties need to be grandfathered. Labor has got it right to grandfather existing investment properties, a policy I strongly stand by. Without this, it could lead to property Armageddon.

https://www.propertyobserver.com.au/forward-planning/advice-and-hot-topics/90631-labor-s-negative-gearing-policies-are-flawed-doug-driscoll.html?utm_source=Property+Observer+List&utm_campaign=8342d213aa-EMAIL_CAMPAIGN_2017_09_28_COPY_01&utm_medium=email&utm_term=0_a523fbfccb-8342d213aa-245616761&fbclid=IwAR0ZOFYIyiUHask8zjzTs7V1-2OV1hBjD0B6PcoZ0BISV9QxFQSJiSwRUwk | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Thu 24 Jan 2019, 1:26 pm Thu 24 Jan 2019, 1:26 pm | |

| Now more holes exposed in Labor's flawed poorly thought out Socialist policies. Then Labor's union brown nosers' inability to manage the economy is well known.Labor super policy flawed: industry groupUPDATED 24 SEPTEMBER 2018  AIG CEO Innes Willox says he would welcome further consultation over Labor's superannuation policy. (AAP) The Australian Industry Group says an analysis of Labor's policy to improve the retirement savings of women shows it would be ineffective and burden business.Businesses will face higher costs and more red tape without any significant benefit to women if a Labor government went ahead with changes to superannuation, a peak industry group says. Federal Labor has proposed to remove the $450-a-month income threshold below which employers are not required to make super contributions. Labor leader Bill Shorten says this will give women a fairer go when it comes to superannuation. But Innes Willox from the Australian Industry Group said new analysis showed the policy would add much more to employer costs than it would add to the retirement incomes of women. "Improving retirement incomes for women is of course an important goal," Mr Willox said. "However, the removal of this long-standing threshold will add significantly to the direct costs of employment and to business compliance costs." As well, the extra superannuation guarantee payments will give rise to higher payroll tax liabilities, he said. About a third of the funds would be paid into the superannuation accounts of males, the analysis found. And of the remaining additional contributions, 15 per cent would be paid in federal tax and another proportion would be deducted as fees by superannuation funds. Mr Willox said he would welcome further consultation over the policy. https://www.sbs.com.au/news/labor-super-policy-flawed-industry-group?fbclid=IwAR1G955RKNHZPQsXeu3vKlfp3A9rHGqI2Uc5NntcBhbxvQLXfYMV_tC2Qqo | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Thu 24 Jan 2019, 11:46 am Thu 24 Jan 2019, 11:46 am | |

| Now what do some real people not conned by GetUp! propaganda reckon.

maaprj 1 WEEK AGO

Very concisely put.

I'm pretty sure if it comes to Labor making a choice between fairness and political expediency on this issue - I'll be losing my franking credits. Not happy, as I've worked hard for over 40 years (and paid full tax on salary - with no significant deductions) . I should mention I've never received any government welfare. I did this because I have a solid work ethic, and wanted to fund a modestly comfortable retirement.

However, it seems the pain of government reaching unfairly into my pocket is never ending. Now if I'd sat on my bum for 40 years and and made no contribution to society - I wouldn't have this problem.

Cyber Robin Hood 1 WEEK AGO

The counter argument.

Retirees would need 9% more savings under Labor franking credit plan

https://www.theguardian.com/australia-news/2018/sep/25/retirees-would-need-9-more-savings-under-labor-franking-credit-plan-report

Pensioners would retain cash refunds on franked dividends

https://theconversation.com/pensioners-would-retain-cash-refunds-on-franked-dividends-under-labor-backdown-93972

Franking Credits used to offset against deductions means less tax but those that do not pay tax cannot expect a refund seems fair.

Dividend Davina still have two other choices as you mentioned in the article aka be Banking Betty or Rental Richard. Just mean a strategy change in her Self Managed Super Funds which is no great impost.

mitch of ACT 1 WEEK AGO

My bet is that as soon as Howard announced that excess franking credits would be refunded Dividend Davina promptly started the process of restricting her share portfolio to give a strong emphasis on companies paying fully-franked dividends.

Now in response to Labor's proposal to stop refundable franking credits Dividend Davina should again start the process of restructuring her portfolio away from companies paying fully franked dividends to those paying unfranked dividends & distributions, e.g. REITS & other trusts. Those entities pay no tax. When comparing yields they are a little less than strong fully franked dividend payers, around 7%, but their prices have not undergone the severe downturn that the dividend paying sector has suffered of late.

The banks, for example, have lost 20%+ of their capital value since their March 2015 highs and have returned grossed-up dividends less than the capital lost. That's nearly 4 years of NIL or less net returns. If Dividend Davina had instead been invested in REITs & Trusts she would be well ahead as that sector has seen strong growth in share prices and around 7% dividend yields. There have also been takeovers in that sector that have significantly boosted returns. | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Thu 24 Jan 2019, 11:20 am Thu 24 Jan 2019, 11:20 am | |

| The problem is the Greeny controlled Labor Socialist attack on Australia is deeply flawed and poorly thought out and is just like their NeverBuiltNetwork that is a disaster that only Labor's incompetent union brown nosers could create.

Labor's legendary incompetence at managing the economy is about to explode onto Australia again with catastrophic results just like Labor's last six sick years of Socialist waste and disgrace and shame.The glaring problem with Labor’s dividend franking policyBy Scott Phillips 16 January 2019 — 12:00am Kudos for announcing it in advance but the Labor Party's franking credit policy is deeply flawed.Labor is going to the election with a three-pronged approach to tax investors. VIDEO: Labor's backflip on dividend imputations:- https://www.canberratimes.com.au/video/video-news/video-federal-politics/labor-backflips-on-dividend-imputations-20180327-53nra.html After a tough few weeks debating their new dividend imputation tax reform, Opposition Leader Bill Shorten assured pensioners they would not be effected by the proposal. Firstly, they are planning to wind back negative gearing on property, other than new construction. Secondly, they’re planning to lower the capital gains tax discount on long-term gains. And thirdly, they’re planning to scrap the refund of franking credits in most circumstances. Two reasonable people can hold intelligent, thoughtful but differing views on the first two.  . Taxpayers protesting the proposed changes.CREDIT:DOMINIC LORRIMER The third, though, is both unfair and deeply flawed.Before you fire off an e-mail to either abuse me or suggest I be knighted, let me explain. I’m going to start with three premises that I think most people can agree on: One, the tax system should be fair. Two, you shouldn’t have to pay tax twice on dividend income. Three — and thanks, Captain Obvious — the tax system, as it stands, is broken. Now, before we go any further, please leave your political affiliations at the door. I’ve bagged and praised both major parties for their different policies. I’ll continue to do it but if you can’t put aside your team jersey and engage in a discussion of ideas, then there’s not much for you in what follows. Bill Shorten’s policy on franking credits goes something like this: “We’re happy for you to reduce your tax using franking credits, but we’re not going to give you a refund.” Now, don’t get me wrong, I think the current situation — regarding the ability to pay exactly zero tax on certain income in retirement that might be up to $80,000 — is crackers. But Shorten’s policy doesn’t fix that problem.Here’s why. Consider three people, all of whom have Self Managed Super Funds in pension phase, and who — according to the current tax rules — pay zero per cent tax: Banking Betty, Rental Richard and Dividend Davina. Banking Betty deposits $100,000 and earns $2000 each year in interest. Betty doesn’t pay any tax. Rental Richard has a $100,000 property that pays him $2000 each year in rent. Richard doesn’t pay any tax. Dividend Davina buys $100,000 worth of shares that earned a profit of $2000. The company paid tax of $600, so Davina gets $1400. Davina doesn’t pay any tax. See the difference here? Because Davina’s investment is in the form of shares, she gets less than the other two. Even though she’s not supposed to pay any tax, the company paid tax, so she gets less. Under current rules, she’d get the $600 back, delivering on the government's policy of a zero per cent tax rate, and equalising the return for each of the three investors. Bill Shorten, in effect, is penalising investors for owning shares. Now, let’s address the elephant in the room.Yes, because the company has already paid tax on that $2000, Davina does officially get a refund. And the optics of that are bad: it looks like somehow the taxpayer is subsidising Davina. However, it’s all a question of cash flows and timing. The Australian Taxation Office just gives Davina back the money the company paid in tax. And remember, a company is just a legal structure to organise your ownership interest in an asset. Shares in a company aren’t all that different, in effect, to accounts at a bank. Your bank account is evidence that you have a claim to a share of the bank’s assets, even if you don’t know specifically which notes you deposited. Imagine a scenario under which Banking Betty’s bank withholds 30 per cent of her interest and sends it to the government as tax. And where Rental Richard’s property manager is obligated to send 30 per cent of his rental income to the ATO. Both of these investors would have to fill out a tax return and the ATO would send them a refund — because tax was paid on their income, even though the tax rate should have been zero per cent. Would Bill Shorten stop Betty and Richard from getting their money back? I doubt it. Essentially, because of the asset class they decide to invest in, our three protagonists are being treated differently. Sound fair to you? No, me neither. Yes, the idea of a "refund" for someone who has paid no tax feels, somehow, deeply wrong. But it’s because tax was paid by the company, on behalf of a shareholder who shouldn’t be paying tax, so the ATO is essentially just righting that wrong. Still with me? Still fuming that well-off people pay no tax? Me too. Frankly, either income inside superannuation or distributions from super should be taxed, progressively, above a generous tax-free threshold. But neither party seems prepared to confront the elephant in the room. Instead, Labor’s policy of penalising a subset of a subset of a population — either because of a poorly formed policy or rank political opportunism — is a terrible solution to a legitimate problem.I’ve sought a response from both Bill Shorten and Chris Bowen but thus far to no effect. Maybe it’s the elephant that dare not speak its name. https://www.smh.com.au/money/super-and-retirement/the-glaring-problem-with-labor-s-dividend-franking-policy-20190115-p50rjq.html | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Thu 24 Jan 2019, 10:41 am Thu 24 Jan 2019, 10:41 am | |

| But you don't know what the grasping greedy unions have planned once they get your money do you ?

Last edited by Patriot on Thu 24 Jan 2019, 11:30 am; edited 1 time in total | |

|   | | Veritas

Posts : 572

Join date : 2018-07-17

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Thu 24 Jan 2019, 9:13 am Thu 24 Jan 2019, 9:13 am | |

| https://www.theaustralian.com.au/business/financial-services/satisfaction-higher-in-industry-super-funds/news-story/75ec1e4206e0213beca226e4575624bb - Quote :

- Union-backed Industry Super funds outperform their retail counterparts overall, but some smaller funds continue to generate lower returns, costing a new worker up to $500,000 by the time they retire in a worst case scenario modelled by the Productivity Commission.

- Quote :

- Industry superannuation funds are on track to overtake self-managed super funds to become the dominant players in the $2.7 trillion retirement savings system within the next two years.

The remarkable shift is being driven by a combination of factors, including industry funds' superior investment returns and members switching from retail super funds in the wake of damning hearings at the banking royal commission.

Some in the DIY super sector have moved their money to an industry fund after finding it difficult to get good returns in the face of the added cost and complexity associated with self-managed super. | |

|   | | Veritas

Posts : 572

Join date : 2018-07-17

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Thu 24 Jan 2019, 7:48 am Thu 24 Jan 2019, 7:48 am | |

| Well lets get it right and stop the scaremongering anti-union claptrap.

Fact.... a great many Industry Super funds are better performing than a great many non-Industry funds. | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Wed 23 Jan 2019, 11:56 pm Wed 23 Jan 2019, 11:56 pm | |

| It is important to share the gloom and doom that will permanently blanket the Shorten shemozzle with the voters to scare the legs off them before the election.

Labor’s High-Tax Policies Would Be Aspiration Killers

Many Australians remain in holiday mode. But post-Christmas credit card bills, the return to work and tumbling property values in Sydney and Melbourne are prompting many people to take stock. In doing so, four months from the federal election, it makes eminent sense to compare the key economic policies of the Coalition and Labor and how they would pinch the hip pockets of households and businesses for years or even decades to come. As the nation faces the likelihood of a change of government, Bill Shorten and his Treasury spokesman, Chris Bowen, to their credit, have not shied away from setting out a detailed economic narrative.

Under the guise of “fairness” they have stuck with it, regardless of criticisms from those who would lose heavily as Labor shifted the nation towards higher taxes, bigger government and a more omnipotent welfare state.

For the past week, this newspaper has cut through the argy-bargy, putting the blowtorch to key issues in play and how they will affect voters’ hip-pocket nerves, such as capital gains and personal taxes, negative gearing, welfare changes, superannuation and workplace relations. After crunching the numbers and considering the arguments of Josh Frydenberg and Mr Bowen, it is clear that voters who aspire to greater prosperity owe it to themselves and to their families to assess the cost benefits of the parties’ contrasting policies.

A week ago, The Weekend Australian examined Labor’s plan to hike capital gains tax. It would see Australians taxed up to 36.75 per cent on capital gains, compared with 23.5 per cent now. While 885,530 taxpayers declared capital gains in 2015-16, mainly from shares and investment property sales, the cost of the opposition’s pledge largely has slipped under the radar, unlike its promised crackdown on negative gearing. In supporting Labor, voters would be supporting the highest CGT rate in the Anglosphere. US investors pay 23.8 per cent tax on capital gains, the British 28 per cent on residential property and 20 per cent on other assets, and Canadians 16.5 per cent. According to home builder Tamawood, which has slashed its profit expectations by 26.9 per cent, Labor’s changes would help create a “perfect storm” in depressed real estate markets. Mr Bowen was notably unapologetic, noting that 70 per cent of the current CGT discount advantages the top 10 per cent of income earners.

Quasi class warfare also pervades Labor’s income tax policy, under which more than a million Australians, double the current number, would find themselves paying a top marginal rate of 49 per cent within six years, Treasury figures show. Labor’s top rate, one of the highest in the world, would cut in at 2.2 times average full-time earnings, compared with eight times average full-time earnings in the US.

Not everyone would lose under a Shorten government, however. After 20 years of welfare reform guided by the sound principles of Bob Hawke’s “reciprocal obligation” and John Howard’s “mutual obligation” policies, Labor has announced a softer approach to jobseekers, including redesigning work for the dole and ditching the need for the unemployed to apply for 20 jobs a month. The Business Council of Australia wants the system overhauled, arguing employers are bearing the costs of sorting through unsuitable job applications. Further reform is needed, mainly because welfare continues to account for more than a third of federal spending. It would be disastrous, as Noel Pearson warns, if Labor caused a backslide towards the passive welfare dependence that hard-won reforms of the past 25 years helped overcome.

As the population ages, the retirement policies of both major parties demand close scrutiny if workers’ superannuation returns are to be maximised and reliance on the Age Pension reduced. Both major parties have mixed records on super. But as reported today, Treasury estimates show Labor’s proposed changes could leave up to a million workers worse off through tax changes and abolition of the government’s measure to allow concessional catch-up contributions. The opposition, dominated by the union movement, which controls lucrative industry-based funds, has blatantly rejected the Productivity Commission’s main recommendation for improving retirement savings.

Superannuation is just one area in which the unions would dominate a Shorten government. Labor has pledged rigid regulation of workplaces and agreed to allow unions to make wage claims on multiple employers. That move, Australian Industry Group chief executive Innes Willox warns, has “left the door open to rampant industrial disputation across the entire Australian economy”. Next week’s strike at a Wollongong colliery over labour-hire workers is a foretaste of what could be expected.

While exasperated by much of the drivel that passes for political debate and by the Coalition’s internecine warfare, voters, in their own interests, should scrutinise the costs of the parties’ policies. If Coalition MPs are to lift their dismal act they should recall how the mantra “It’s the economy, stupid” propelled Bill Clinton to power in 1992.

As the government achieves the first surplus since Mr Howard lost office, it has the ammunition to take Labor apart, point by point, tax by tax, dead-handed policy by policy, and highlight the dangers of stumbling blindly down a socialist dead end. Unless more ministers plunge in and fight on their ground — growth and jobs — they and Australians aspiring to be justly rewarded for hard work are on a hiding to nothing.

| |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Wed 23 Jan 2019, 11:49 pm Wed 23 Jan 2019, 11:49 pm | |

| Libs main job is to put the fear of Shorten into the voters leading up to the election so voters will wince and shudder every time they hear that awful name.

Labor’s Tax Grab Will Hurt Our Economy

When voters go to the ballot box this year, they will face a clear choice. It will be between a government that has delivered lower taxes, lower spending and more than 1.2 million new jobs and a Labor Party that has promised $200 billion in new taxes to fund reckless spending promises.

While much of the focus has been on changes to negative gearing and franking credits, Labor's plan to increase capital gains tax by 50 per cent has gone largely under the radar. This is despite the fact Labor's CGT changes will raise more than $12bn, around two-thirds of what Labor is expecting to raise from its changes to negative gearing.

Again, Labor is walking away from more than two decades of bipartisan tax policy, with the current CGT arrangements introduced by the Howard government in 1999 with Labor's support. Until then, capital gains tax was levied on the asset cost base after deductions for inflation. In the parliamentary debate at the time, Labor members were enthusiastically in support of the Coalition's CGT changes, with current frontbencher Joel Fitzgibbon saying, “I give a tick to the measures of the 50 per cent reduction in CGT. I have no argument with that,” and Labor senator Joe Ludwig saying, “This should improve our overall international competitiveness.”

Now, however, in a desperate grab for revenue, Labor's attitude has changed. If Labor is successful in legislating a 50 per cent increase, it will see Australians subject to a capital gains tax rate that is higher than any comparable country. This includes the US, Britain, Canada, New Zealand, Japan, Germany, France, Ireland and South Africa.

The consequential and damaging impact on the economy from the CGT increase will be significant. The independent Centre for International Economics has estimated that the capital gains tax hike will lower GDP by $3.7bn a year; reduce real wages by 0.7 per cent, equivalent to about $600 a year for someone on average full-time earnings; reduce construction activity by more than 3000 dwellings a year, leading to higher rents; and damage state balance sheets with reduced GST distribution and property tax collections by about $1bn a year. This would put state governments, in the words of the CIE, under “severe pressure”.

The overall contraction in the economy that follows Labor's CGT changes also will have a negative impact on the federal government's coffers. The CIE report says that while CGT receipts may increase, there will be a fall of more than $2bn in other tax receipts as the economy slows. The net revenue increase therefore from the C GT changes may be less than $500m, a fraction of what Labor is counting on. This creates the invidious but not unprecedented scenario for Labor (think mining tax) where it commits to new spending on the assumption of a tax revenue windfall that never eventuates.

Initially, Labor framed its justification for a capital gains tax increase around the issue of rising housing prices. However, three years later, the housing market is very different. Prices in capital cities have been falling, not rising.

Labor's initial justification no longer holds, yet it sticks to its policy. This is because, philosophically, Labor has abandoned the aspirational class. The would-be investor, who through their thriftiness and personal responsibility, saves for their own retirement is now a target for Labor.

It was Paul Keating who not long ago said of Bill Shorten's Labor Party that “it has lost the ability to speak aspirationally to people and to fashion policies to meet those aspirations”.

Shorten believes it is only “the very wealthy” who are trying to “turn their income into capital”. But the reality is different. Tax data shows that in the 2015-16 year, nearly 900,000 individuals had a capital gain on their tax return. These are not necessarily high-income individuals. Just as the tax data on negative gearing showed two-thirds of the people using this concession had a taxable income of under $80,000 a year, so too with the capital gains tax discount there will be many teachers, nurses and emergency services personnel who are making modest investments to build their nest egg.

You have to look no further than Labor's national conference for evidence that the modern Labor Party is all about redistributing the pie and not growing it. Labor's focus is solely on the equality of outcomes in contrast to the Coalition, which is focused on equality of opportunity.

You have to wonder about the motivations of a shadow treasurer and Labor Party that believes a 50 per cent tax increase is an example of “perfectly designed and calibrated policy”. It reveals their unashamed determination to increase taxes regardless of the adverse effect it will have on investment, jobs and the economy.

Wealth creation for Labor is a dirty word, despite it being the means by which all Australians aspire to a better life. This is what the Coalition believes in and this will be at the heart of the contest at the next election. | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Wed 23 Jan 2019, 8:27 pm Wed 23 Jan 2019, 8:27 pm | |

| The Lefties are getting a bit jumpy now as even they can see Labor sliding as the voters learn what a disaster Labor will be, even worse than last time.

Now Labor HATES Small Business and they will smash them with everything they can find.

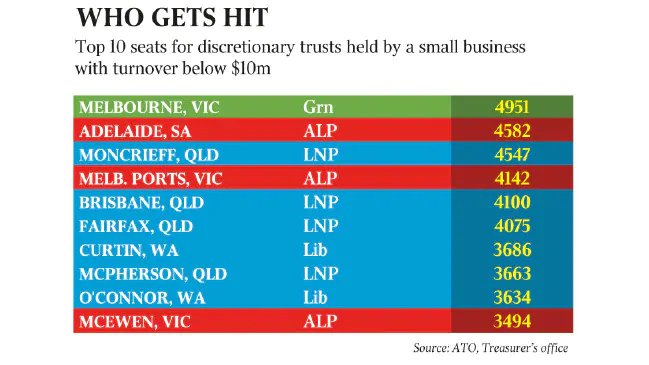

Labor's badly thought out socialist chaos here reminds one of their NeverBuiltNetwork disaster where nothing was costed or designed or understood.Labor’s trust tax ‘to hit small business the most’ADAM CREIGHTON 12:00AM JANUARY 18, 2019  Josh Frydenberg says Labor’s policy to impose a minimum 30 per cent tax on trust distributions would ‘hit around 300,000 small businesses with turnover of up to $10 million’. Picture: AAP Three of the top five seats most affected by Labor’s plan to impose more than $17 billion in tax on family trusts over the next decade are Labor or Greens, according to an analysis of tax office data by the Treasurer’s office.Labor’s policy to impose a minimum 30 per cent tax on trust distributions would “hit around 300,000 small businesses with turnover of up to $10 million” including almost 114,000 in Labor seats, Josh Frydenberg told The Australian. “This is a stark reminder how Labor’s $200bn tax hit would hurt people in their own backyard,” the Treasurer said. “Aspirational and hardworking Australians are not confined to certain postcodes or cities, they can be found in every corner of every electorate across the country.” The Treasurer said a father and son carpentry business that made $110,000 in one year, for instance, could face tax increases of up to 180 per cent if they lost access to the individual tax-free thresholds available to each under current trust law.  “Bill Shorten, as minister for financial services and superannuation, said in 2011, ‘We don’t believe trusts are any form of tax avoidance’,” Mr Frydenberg said. Melbourne Ports and Adelaide would be the top two Labor seats affected by Labor’s plan, each with more than 4100 trusts with turnover below $10 million. Greens-held Melbourne had the most trusts of any seat, while six of the top 10 seats that would be affected were Coalition seats, with Moncrieff in Queensland the highest in that group.

Of the 570,400 discretionary trusts in Australia, 291,200 had turnover under $10 million, of which 113,487 were in Labor seats, according to tax office statistics.Labor Treasury spokesman Chris Bowen said 98 per cent of all taxpayers were unaffected by Labor’s trust proposal, which was announced in 2017 and was estimated to raise more than $4bn over four years. “Labor’s reforms to the taxation of trust is simply an extension of John Howard’s work as treasurer, in seeking to apply a minimum standard tax rate of 30 per cent to discretionary trust distributions to beneficiaries over 18 years of age,” Mr Bowen said. Mr Howard in the early 1980s introduced penal levels of taxation on distributions from trusts to children; in effect stopping income-splitting to minors. Lance Cunningham, national tax director at BDO, said Labor’s proposals were “ad hoc” and “certainly could have unintended consequences … They would probably have most detrimental effect on smaller businesses because better-off individuals use trusts and companies together to ensure their maximum tax rate is 30 per cent. In a submission to cabinet, former treasurer Peter Costello in 1997 proposed taxing trusts as companies, according to recent archival release. https://www.theaustralian.com.au/national-affairs/treasury/labors-trust-tax-to-hit-small-business-the-most/news-story/e70cc094bc7e8845f724d9a1b72eaa92 And some factual accurate assessments of Labor's stupidity.Kenneth 4 DAYS AGOI don’t understand this furore over trusts. Profits flow through trusts and must be distributed every year to the beneficiaries who then pay tax on these earnings with minors having a very low $400 odd limit for tax free distribution over that the top marginal rate was applied. So all this rot that people go on about the tax savings are complete LIES We don’t have a family trust but I can see why small business uses it to keep hold of their cash to counter the ebb and flows of business, if you make them pay themselves PAYG many won’t have the cash flow to function. Simon 5 DAYS AGOSuperb analysis - the only way Labor can implement its lofty promises is to penalise taxpayers - we will all be worser off under Labor! Pat 5 DAYS AGOSo small businesses, their trusts, their SMFS, and pensioners reviving franked dividends are to be taxed at 30%, while the franked dividends received by the industry funds - into which this kleptocratic cabal of unionists, political puppets, and apparatchiks - pour the huge amounts of super deducted from their inflated salaries, will be taxed at zero%, not 30% ? Paul 5 DAYS AGOTrusts just aren't what they were, already. The swag of changes announced by Labor add up to a considerable impost on small businesses. The belief that the owners will likely pay more tax while seemingly accurate ignores the actuality of where those taxes will come from. Removing up to $20B a year from the economy will have consequences, many of which remain unknown. People impacted will reduce investment. They will also seek labour cost savings, likely the ultimate sacrifice for the tax imposts. I may end up paying more tax but the ultimate source of that money will be someone or something else. | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Wed 23 Jan 2019, 7:49 pm Wed 23 Jan 2019, 7:49 pm | |

| Prepare for untold chaos and devastation if the Greeny controlled Labor gets in.

Already their silly unfunded rubbish and $200 billion of new taxes is collapsing around their ears. Labor are hopeless at managing the economy just as they were last time and they have the recycled failure Swanny back to guide them to disaster.

Mr Frydenberg, speaking in Sydney on Tuesday, said Labor's tax policies were a particular risk given the headwinds now evident from overseas.

"We cannot, as a country, risk Labor's $200 billion of new taxes that will hurt everybody who owns a home and everybody who rents a house. That will hurt retirees and people who are planning for retirement. That will hurt small businesses and workers in big businesses," he said.

Josh Frydenberg says Labor's tax plans will hurt the economy at the worst possible time.

"The Labor Party's answer to the global storm clouds across the international economy is higher taxes. It's the wrong prescription and they have the wrong diagnosis." | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Wed 23 Jan 2019, 7:10 pm Wed 23 Jan 2019, 7:10 pm | |

| Even the lefty Guardian is sounding the warning bells for Labor over Bilious Billy's blunders.

And while the Lefties complain about presenting the FACTS (which they fear) it is a lot quicker and easier to find an appropriate article and simply present that.

See the Lefties idea of "debate" is to simply exchange the rotting decaying contents of their minds with each other with NO NEW INFORMATION ALLOWED.Will Bill Shorten's tax strategy make him a winner or cost him the election?Richard Denniss Wed 23 Jan 2019 13.33 AEDT Last modified on Wed 23 Jan 2019 13.36 AEDT For the first time in a generation, we get to vote for competing ideas on revenue collection. Get your popcorn!  Federal opposition leader Bill Shorten is seen during the launch of his "Queensland Jobs Not Cuts" bus tour in Beenleigh, south of Brisbane, January 17, 2019. ‘The best thing about living in a democracy is that the decision about whether we collect more revenue and spend more on services, or cut taxes further and spend less on services, will be made by you’ Photograph: Dan Peled/AAP It’s time we talked about tax. Bill Shorten wants to close tax loopholes and spend more on schools and hospitals. Prime minister Scott Morrison wants to scare voters about the perils of a high-taxing Labor government. And the business community still want the Liberal’s big cut in the company tax rate, but they also want Labor’s proposed tax concessions for new investment. While there is no agreement about what shape “tax reform” should take, there is overwhelming agreement between the major political parties that this year’s federal election will be a referendum on tax. And the best thing about living in a democracy is that the decision about whether we collect more revenue and spend more on services, or cut taxes further and spend less on services, will be made by you. History and geography make clear that there is no “right” amount of tax revenue to collect. The Nordic countries have some of the highest tax/GDP ratios in the world and also have some of the most prosperous and cohesive societies. Many developing countries in Africa and Asia have very low levels of tax collection and some of the weakest economies in the world. If investment simply flowed to the countries with the lowest tax rates then all of the world’s cars, computers and clothes would be manufactured in tax havens like the Cayman Islands. But of course, despite their low taxes, almost nothing is produced in tax havens – beyond accounting services. There is also clear evidence that there is no “right” way to collect the amount of tax preferred by a country’s citizens. The “lefties” in the US have a strong preference for the kind of property taxes and wealth taxes that give Morrison and treasurer Josh Frydenberg conniptions. The Tories in the UK oversee a 40% inheritance tax, which in Australia would obviously be called a “death duty” and deemed as “class warfare”. Countries as diverse as Sweden and South Korea raise revenue through carbon pricing. Norway has become rich by taxing its oil reserves while Australia has literally chosen to give much of its gas away for free, mostly to multinational companies which pay little or no company tax here in Australia. If one thing is for sure, by May this year we will know who was completely wrongAnd while there is no clear evidence about the right amount of tax to collect and the way to collect it, luckily the Australian constitution allows us to have elections to make such important decisions. After decades of the ALP and Coalition agreeing that lower taxes would deliver benefits that would “trickle down” to the broader community, we are about to have the first election in a generation where the government are keen to place competing ideas about revenue collection at the centre of their election campaigns. Get your popcorn! Conservative commentators seem convinced that Shorten’s plans to close tax loopholes like the capital gains tax concession, negative gearing for investment properties and franking credit refunds will cost him enormously at this year’s election. At the same time the ALP’s strategists seem convinced that talking about spending more on schools, roads and hospitals that are funded by making the tax system fairer is a political winner for the opposition. If one thing is for sure, by May this year we will know who was completely wrong. For decades political commentators, and many voters, have complained that the two major parties had become virtually indistinguishable. You don’t hear many people say that anymore. But regardless of what you think of either major party’s policies, the fact that they are offering us, the voters, a clear alternative is to be applauded. While we will need to wait a while for the Australian Electoral Commission to tell us which vision for Australia is the most popular, early signs are ominous for the Morrison government. Shorten spelled out his proposed changes to negative gearing before the last federal election and his clamp-down on franking credit refunds before the Batman byelection, and he did much better in both contests than was expected. The Coalition have been attacking the proposed changes for years in some cases, yet they still lag behind Labor by as much as 10 points in some polls. The Victorian state election provided another rebuke to Coalition strategists who believe that scare campaigns about Labor’s economic management are a substitute for a positive vision for the country. Daniel Andrews trounced his Victorian Liberal opponents at last year’s state election on the back of promises to spend more money on essential services and infrastructure. Australia is one of the richest countries in the world yet as anyone who has travelled to Europe knows, our cities and our essential services are far from world’s best practice. For 30 years Australian voters have been told, by both major political parties, that if we cut taxes and public spending sufficiently, we would become rich enough to have world class services one day. Strangely it didn’t work. Democracy isn’t perfect and it’s not quick, but it was set up to answer big questions about what we want more of and what we want less of. The ALP is doubling down on its strategy of closing tax loopholes and spending more on services. The Liberals are sticking with the importance of cutting taxes and cutting public spending. I can’t wait. https://www.theguardian.com/commentisfree/2019/jan/23/will-bill-shortens-tax-strategy-make-him-a-winner-or-cost-him-the-election | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Tue 22 Jan 2019, 5:04 pm Tue 22 Jan 2019, 5:04 pm | |

| Prediction of the disaster to come. Once the Greenies take over control of the Senate they will demand that Labor RESTART the BOATS - just like last time. The Greenies will also bring back the carbon tax. Anyone who thinks that Labor will keep any of its election "Promises" is dreaming because the Greenies will change everything to what they want. Like Gillard was just the puppet of Bob Brown Bilious Billy will be the puppet of Doc Dick. And if Rob Oakeshott gets in all that will be missing is Tony Windsor. There is not the slightest doubt that a Greeny controlled Shorten "Govt" will be by far the worst "Govt" in Australia's history presiding over the worst most chaotic brothel ever seen.  The Greeny controlled Labor will EASILY beat this tiny number.  And the Greeny controlled Labor will stick the boot into the hated small businesses with crippling penalty rates that will throw people out of a job. | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Tue 22 Jan 2019, 2:55 pm Tue 22 Jan 2019, 2:55 pm | |

| The BIG question everyone is asking is IF Labor gets in then how many illegal invader boats will arrive in the first year ?  Boats ahoy!!! Will SHY be the commander in Chief of the people Smugglers again ? | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Tue 22 Jan 2019, 2:22 pm Tue 22 Jan 2019, 2:22 pm | |

|  The storm clouds are gathering over Labor and Bilious Billy who has the charisma of a used tea bag. This could be the 'unloseable' election for Labor that is lost... They should walk in, in light of the results of the Banking Royal Commission however........... Shorten's policy on Superannuation is going to hit hard working people who have provided for their own retirement like a ton of bricks. Then there is the removal of Negative Gearing in a Housing Market that is in freefall. Did anyone mention the word 'recession'? There are also extremely worrying signs on how Labor is going to handle the 'Country Shoppers'. Seems like all they will need is a signed chit from a doctor they'll get in. | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Tue 22 Jan 2019, 10:05 am Tue 22 Jan 2019, 10:05 am | |

| Labor's insanity is becoming clearer as the murk on it is lifted.Labor's tax hike costings seem opportunisticBy Noel Whittaker 19 January 2019 — 12:00am Capital gains tax will be a major topic as we race to the next federal election. Treasurer Josh Frydenberg was on the attack last week, pointing out that if Labor’s capital gains tax (CGT) proposals become law, Australians will be paying CGT at one of the highest rates in the Western world. Treasurer Josh Frydenberg says if Labor’s capital gains tax proposals become law, Australians will be paying CGT at one of the highest rates in the Western world.CREDIT:MICK TSIKAS Our top marginal income tax rate is 47 per cent, including Medicare. This means a top-rate taxpayer now pays 23.25 per cent CGT, when the 50 per cent discount for holding an asset for more than 12 months is applied. Labor intends to raise the top marginal rate to 49 per cent by reinstating the 2 per cent Budget Repair Levy. And to reduce the 50 per cent CGT discount to 25 per cent. If Labor succeeds in making both these changes, a top-rate taxpayer will suddenly find themselves paying CGT of 36.75 per cent – an increase of almost 58 per cent. Labor reckons the tax hike is necessary to bring the budget back into surplus and they are projecting a saving to the bottom line of about $12 .6 billion over 10 years. However, like many of Labor’s costings, this one seems rather optimistic. For starters, they are promising the increased rate of CGT will apply only to assets acquired after the changes become law. If they do get elected in May, it’s almost certain that the legislation would not be enacted until mid-2020. Therefore, it should only affect assets purchased after that date. Next, the discount applies only to assets held for more than a year. So no assets would be affected by the proposals for at least three years from today. Now think about the type of people who buy investment property, which is where the CGT rate is most important. One thing is certain – any changes to CGT will be beneficial to shares. Most are suspicious of superannuation, regard shares as a bit of a punt, and try to secure their long-term future by putting together a stable of investment properties so they can live off the rents when they retire. It’s highly unlikely that they will be cashing them in any time soon. There has been a lot of speculation about what Labor’s proposed CGT changes would do to the economy in general, and the housing market in particular. There is no obvious answer. Given that Labor has promised the tax status of existing assets will be unaffected, there would be no reason to sell assets now and incur unnecessary CGT. One likely short-term result would be a spate of buying prior to the changes, as investors rush to beat the rule adjustment, followed by a slump. Certainly, if the rules do change, investors will be reluctant to sell assets purchased after the rule change because the cost of doing so would be much higher. In any event, I have long believed that tax is just one of many factors that influence investment decisions. If you can make a great profit now, and you believe the asset has peaked, it still makes perfect sense to reap the rewards immediately and pay whatever tax is due. One thing is certain – any changes to CGT will be beneficial to shares. Property and shares are the two major investment assets but shares have one unique asset – the ability to sell in part. Think of two retirees – one has $1 million in shares, the other has $1 million in two investment properties. The share investor can sell assets at a slow rate as funds are needed, keeping themselves under the tax-free threshold and will almost certainly pay no CGT. It’s a different matter for the hapless property investor – they can’t sell the back bedroom, so the only way they can release money to live on will be to sell one of the properties and pay a big chunk of CGT. https://www.smh.com.au/business/the-economy/labor-s-tax-hike-costings-seem-opportunistic-20190117-p50rvl.html COMMENTAlex G 2 DAYS AGO Let's fact check the claim that Australia under labor's proposal would pay one of highest rates of CGT in the Western World: USA: Top rate of 23.8% UK: Top rate of 28% on property and 20% on all other assets Japan: Top rate of 20% on assets other than property, property owned less than 5 yrs 40%, property owned more than 5 yrs 20%. Germany: CGT rate of 26.375% , property owned more than 10 years exempt. Canada: Top rate of effectively 27% in highest taxing province. Canada has the same 50% discount concept as Australia. France: To complicated! France even has a wealth tax and various additional taxes, deductions and time frames relating to CGT... All these countries exempt the primary residence from CGT. So yes, it is very accurate to say that Australia will have one of the highest CGT rates in the Western World, in fact, at a top rate of 36.75% only one instance, being property held for less than 5yrs in Japan, out of all those countries will Australia be lower taxed. In other words, Labor is proposing to subject Australia to the largest CGT rates in the developed World. And before I see the usual, 'tax is the price of civilisation' justifications, all those other countries are pretty civilised wouldn't you say? The reason you have the capital taxed at a lower rate is because it recognises that capital creates employment, and equally important the capital gain often does not happen in one financial year like income! The 1 million gain on an investment property held for 15 years didn't happen in year 15, you get my point? It's logical to tax it at, at least, half the rate of income for that very reason alone because we have a progressive taxation system. If that 1m gain was spread over 15 yrs it would be taxed at a much lower rate assuming an average income of the owner. Anyone that is wondering about how they are going to secure their retirement should think very carefully about supporting a massive increase in CGT. That 1m gain for your retirement is currently taxed at $235,000, Labor's proposal increases that to $367,500. That's real money, that's $132,500 less for your retirement or to help your children. | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Tue 22 Jan 2019, 9:53 am Tue 22 Jan 2019, 9:53 am | |

| Gee the scared confused Lefties are swirling around and lashing out at anything that moves.

Labor's dividend plan will smash mum-and-dad shareholders.

Even the superannuated past Labor failures are speechless over Bilious Billy's blunders.Keating government adviser Vince FitzGerald slams Labor's 'horrible' dividend taxBy John Kehoe Updated 17 Jan 2019 — 5:32 PM, first published at 5:17 PM Labor's plan to scrap cash refunds for franking credits to low-taxed investors is a "horrible" complication of the tax system that will unfairly penalise self-managed superannuation funds, says the economist who led the Keating government's review of national savings.  Vince FitzGerald slammed Labor's move and said there were better ways to extract more tax from wealthy retirees like himself who enjoyed tax-free superannuation withdrawals. "We're about to get a Labor government to get this ridiculous proposition that franking credit refunds will be denied to self-managed super funds," Dr FitzGerald said. Vince FitzGerald says there are better ways to extract more tax from wealthy retirees like himself who enjoy tax-free superannuation withdrawals. "It amounts to having a marginal rate for a super pension of 30 per cent on the original corporate income from which the dividend comes. "Even if you're in accumulation mode where you're marginal tax rate is 15 per cent, you're paying double that. "It will be yet another horrible complication to how super is taxed." If Labor wins the election, as opinion polls suggest, it plans to stop investors who pay no or little income tax – except pensioners – claiming tax refunds for excess imputation credits for dividends, to save the federal budget about $5 billion a year. SMSFs with at least one pensioner or allowance recipient before March 28, 2018, will be exempt. Dividend imputation was introduced by then-Labor treasurer Paul Keating in 1987 to eradicate double taxation. It entitles a shareholder to a tax credit on a dividend which is equivalent to the tax already paid by a company. The Howard government made the system more generous in 2000 so that if a shareholder had an imputation credit higher than their personal tax liability, the investor would receive the excess credit as a cash refund. 'Unfair and unsustainable'Labor wants to bring the system back in line with its original 1987 design and has said it gained Mr Keating's endorsement. Under Labor, franking credits for company tax paid would still be available for shareholders to avoid double taxation. Shadow treasurer Chris Bowen said: "Politics is about choices. Labor makes no apologies for choosing schools and hospitals over tax concessions that overwhelmingly benefit the wealthy. "The cost of excess imputation credits will soon outweigh what the commonwealth spends on schools or childcare. That's unfair and unsustainable. "Ninety-two per cent of taxpayers do not receive excess imputation credits and Australia is the only developed country in the world that allows these credits." Dr FitzGerald, a former Treasury official who led the 1992 inquiry into national savings for Keating government treasurer John Dawkins, said a better approach to collect more tax on super from the wealthy would be to have tax-free super contributions and earnings so balances accumulate faster, with withdrawals being taxed at marginal rates. It would tax lower and middle-income earners less and collect a "lot more from well-off people like me" who would be paying the top marginal rate each year on withdrawals. "That's what most countries do and it's conducive to getting the best result over the long term," Dr FitzGerald said. "Instead, we've done terrible things and put bandaid on bandaid on bandaid. "Under my proposed system a government would leave a lot of money on the table for future governments to look after older people." 'Preferential treatment'Treasurer Josh Frydenberg has repeatedly lashed Labor's plan for $200 billion-plus in tax hikes over a decade. Mr Frydenberg argues Labor's "retiree tax" will hit 900,000 individuals with excess franking credits and they will lose on average $2200 a year and 200,000 self-managed super funds would lose on average $12,000 a year. "This is part of Labor's plan for more than $200 billion in additional taxes of people's properties, incomes, business and savings. In contrast, our government will protect the hard-earned savings of Australians," Mr Frydenberg said this week. Economist Saul Eslake has said Labor's franking policy would reverse a "dumb" tax break for people paying little or zero tax. "There is always angst when you look to take away a particular group of people's preferential tax treatment," he said. "People will have to rearrange their financial affairs, but should they ever have had this tax break in the first place?" Read the rest of Labor's brutal attack on Australians herehttps://www.afr.com/personal-finance/superannuation-and-smsfs/keating-government-adviser-vince-fitzgerald-slams-labors-horrible-dividend-tax-20190117-h1a6hk | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  Tue 22 Jan 2019, 9:50 am Tue 22 Jan 2019, 9:50 am | |

| Ignoring the worried Lefties anguished cries as they begin to see the insane sickness gripping the Greeny controlled Labor Party.

Now why pensioners HATE the Labor Party who wants to ROB them.

The utter stupidity of Labor telling the extremely damaging to many people unfunded Socialist stupidity they propose smacks of childish idiocy. GetUp! gumphed.

What lo life Labor is up to is squashing SMSFs and trying to move people onto Industrial Super so the unions can pilfer all this new money.Labor pushes ahead with trust taxMiranda Brownlee 18 January 2019  Labor’s proposed tax for discretionary trust distributions is shaping up to be a key election issue, a proposal which is likely to impact many SMSFs with unit trusts. Labor’s proposed tax for discretionary trust distributions is shaping up to be a key election issue, a proposal which is likely to impact many SMSFs with unit trusts.In 2017, opposition leader Bill Shorten announced that Labor would reform the taxation of discretionary trusts to prevent income from being allocated to household members in lower tax brackets. As part of its reforms, Mr Shorten outlined that Labor would introduce a minimum 30% tax rate for discretionary trust distributions to adults. Following the release of a report on trusts and the tax system by RMIT University this week, Shadow Treasurer Chris Bowen said that Labor’s proposed trust tax would eliminate “tax loopholes” costing the budget “billions of dollars through tax, avoiding income tax shuffles including income splitting via beneficiaries”. The report, which was commissioned by the ATO, stated that over the past six years the Tax Avoidance Taskforce had raised more than $1.2 billion in liabilities and collected more than $467 million in relation to trusts. Participants in the report suggested that reform in relation to trusts could include a withholding tax regime similar to that in place for salary and wage earners, or taxing the trust or trustee as an entity and maintaining the current flow through features of trusts. Mr Bowen stated that Labor’s reforms to the taxation of trusts was “merely an extension of John Howard’s work as treasurer, in seeking to apply a minimum standard tax rate of 30% to discretionary trust distributions to beneficiaries over 18 years of age”. Under current law, unit trusts that are wholly owned by an SMSF pay no tax as the unit trust distributes its net income to the SMSF as the unit holder, which pays a maximum of 15% tax on such distributions. DBA Lawyers director Daniel Butler previously explained that an SMSF would only pay 10% tax on a distribution of a net capital gain from a unit trust after allowing for the one-third CGT discount where the asset was held for greater than 12 months. “An SMSF in pension phase does not pay any tax from such trust distributions subject to each member’s transfer balance cap limit.” While Labor has previously clarified that the new minimum 30% tax will not apply to fixed trusts, the majority of SMSFs tend to invest in non-fixed trusts. “Broadly, trusts are divided for tax purposes into fixed and non-fixed trusts for trust loss purposes under schedule 2F of the Income Tax Assessment Act 1936. Given the strict criteria on what is a fixed trust under this test, most trusts fall into the broad category of a non-fixed trust and these trusts are broadly treated as discretionary trusts for tax purposes,” Mr Butler explained. Labor could therefore tax SMSFs at a minimum of 30% on trust distributions received from unit trusts that are considered a discretionary or non-fixed trust. “Labor’s policy has created considerable uncertainty for investors seeking to undertake investments or enter into new business structures given the broad-brush policy announcement,” Mr Butler said. Treasurer Josh Frydenberg criticised the proposal over Twitter, stating that it would hit “300,000 small businesses with $17 billion on new taxes on trusts”. “Your idea of fairness is now to hit 2 brothers working in a small family carpentry business making $110,000/annum between them with an extra $15,000 of tax/annum. As the Council of Small Business Australia said [it’s] a case of Labor Party going after hardworking small business because they are a soft target,” Mr Frydenberg said in a Twitter post. CommentsGrant Abbott 12 hours ago.I predicted this a while ago. It goes to the policy of making Industry Super Funds the pre-eminent savings vehicle in Australia. When it was mooted a while ago I made submissions that rather than go down a minimum tax route why not treat a discretionary trust like a company so the trust pays 30% tax and distributions have franking credits. Suddenly companies are coming back into vogue. Unit trusts should be exempted otherwise managed funds will get dumped. FAIRisFAIR 12 hours ago.I'd like to see him get taxed at 90% RichardSuttie 13 hours ago.Shorten is the most dangerous man in Australia. He will send this country into a massive recession by destroying incentive for Australians to invest. His proposed policies belong in a socialist regime not Australia Bill Nutton 15 hours ago.further proof that a Shorten government will cripple small business annoyed 14 hours ago.totally agree - on 1 side they want us to support our own retirement and not rely on a pension but they take away our ability to do so with these stupid changes https://www.smsfadviser.com/news/17272-labor-pushes-ahead-with-trust-tax | |

|   | | Patriot

Posts : 544

Join date : 2018-08-14

|  Subject: Voters now frightened of mad crazy Labor Subject: Voters now frightened of mad crazy Labor  Tue 22 Jan 2019, 9:47 am Tue 22 Jan 2019, 9:47 am | |

| With ScoMo and friends help voters are filling with abhorrence at the prospect of being dragged under and their country ruined by the horrific abomination of a mad as cut snakes extremist Greeny controlled Labor "Govt" which would be the worst "Govt" in Australia's history.

Voters are filled with trepidation as they are made aware of the devastation of Australia which would be caused by Labor's unfunded extremely expensive ridiculous Socialist stupidity and the huge tax increases and insane out of control borrowing which would try to fund these absurdities.

There is a dark cloud on Bill Shorten's Labor horizon and it is ScoMo the Shorty killer.‘Radical, aggressive and dangerous’: Treasurer warns of Labor’s spending agendaSamantha Maiden 10:31pm, Jan 21, 2019  Treasurer Josh Frydenberg will argue Labor's policies will set back the country for decades. Photo: Getty Bill Shorten’s tax and spend platform represents the most “radical, aggressive and dangerous” tax agenda Australia has ever seen, Treasurer Josh Frydenberg will warn in a major speech on Tuesday.Speaking at the Sydney Institute, the Treasurer will argue that Labor’s unashamed embrace of higher taxes for business will set the country back decades.

Predicting that a Shorten government will be more anti-business than the Hawke-Keating government and the Rudd-Gillard years, Mr Frydenberg will outline the government’s election pitch on the economy.

“What is absolutely certain is that as a nation we cannot afford to fall for the false prophets who would have you believe that a country can tax itself into prosperity, that a government can redistribute what its economy doesn’t produce, and that growth can be achieved while punishing aspiration,” Mr Frydenberg says.

“For Labor, the pursuit of class warfare is more than rhetoric. It is at the heart of their policies from tax to trade to industrial relations. It’s a dark shadow not a light on the hill.“Labor has ignored the message from the Productivity Commission that our tax and transfer system has been successful in reducing income inequality and that the one constant that matters most in tackling inequality and poverty is having a job. “Instead, Labor is promising one of the most radical, aggressive and dangerous tax and redistribution agendas Australia has ever seen. Putting at risk our prosperity and harmony and taking us back decades.

“No wonder there is now such a loud and growing chorus of opposition. Australians are starting to see Bill Shorten’s plan for what it really is.”The Morrison government has spent the summer ramping up its attacks on Labor’s negative gearing policies, a strategy that proved fruitless during the 2016 election. However, the Treasurer insists the campaign is starting to gain traction. Foreshadowing the speech, Labor’s treasury spokesman Chris Bowen predicted it would just prove more of the same. “Josh Frydenberg is giving a speech on the economy tomorrow. It’s his chance to outline his vision for the economy and announce policies to deal with low productivity growth, high household debt and anaemic real wages growth. But I reckon it will more likely say ‘Labor, Labor, Labor’,” Mr Bowen said. The speech, titled Creating opportunity and encouraging aspiration: The key to a growing economy and a stronger Australia, argues only the Coalition will continue to fight for economic reform. On trade, Mr Frydenberg argues Labor pandered to union interests when debating the free trade agreement with China. “It is no secret that our political opponents equivocated on the China FTA, gave up on the TPP, saying it was ‘dead in the water’ and are now threatening to open up settled agreements at the behest of the unions,” he says. Mr Frydenberg also predicts there are “storm clouds hanging over the global economy”. “Persistent trade tensions, high global debt levels and a contraction in growth in several key economies has changed the global outlook,” he says. “Domestically, the drought is having an impact, the housing market has softened, there are signs that credit growth has been constrained and the pick up in wages growth remains gradual.” In the speech, Mr Frydenberg also makes the case for “Liberal values” on the economy, arguing greater personal responsibility is the key and warning governments cannot fix every problem. https://thenewdaily.com.au/news/national/2019/01/21/treasurer-speech-labor-spending-agenda/ | |

|   | | Sponsored content

|  Subject: Re: Voters now frightened of mad crazy Labor Subject: Re: Voters now frightened of mad crazy Labor  | |

| |

|   | | | | Voters now frightened of mad crazy Labor |  |

|

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |