Which is better - super or manage your money yourself in the stock market ?This article reckons super is better but The New Daily is owned by Industry Super Holdings so it might be just a little biased!!!!!!There is another way of looking at it which suggests the share market is better provided you are good at selecting and managing shares.Stephen BanksI could be wrong, but I think there is a mistake which changes the outcome. I calculate a stock market final portfolio value 1285% of the initial, which is better than the super's 709.9%.

Using given values, the average annual all ordinaries gain is 5.69%. Getting paid 4% dividends per annum and reinvesting increases the annual return to 9.92% (assuming 100% franking). Thus:

((6907.2 / 1549.9) ^ (1/(2019-1992)) * 1.04) ^ (2019-1992) = (6907.2 / 1549.9) * 1.04 ^ (2019-1992) = 12.85 = 1285%.

Stephen Banks

A simpler way to think about it is that, due to 4% dividend reinvestment, the number of shares owned increases by 4% each year (assuming 100% franking and ignoring broker commissions). Thus in the final portfolio the number of shares is 288.33% of the initial =1.04^(2019-1992). Multiplying this by the all ordinaries 455.65% gives 1285%. Mathematically these two interpretations are identical.Why superannuation members shouldn’t be seduced by the siren song of the stockmarketRod Myer 10:15pm, Dec 16, 2019 Updated: 8:36pm, Dec 16

Why super fund members should resist the siren calls of the stockmarket. Photo: Getty

It can be tempting to simplistically compare the returns delivered by super funds with stockmarket returns and draw the erroneous conclusion that members could do better there.It often happens and most recently occurred in The Australian, where finance columnist Alan Kohler compared the returns over five years of a median default fund basket produced by the Australian Prudential Regulation Authority (APRA) with the ASX 200 share index.

He found that when management fees are considered, there was no difference in returns.

It’s not a bad barbecue-starter observation, but there’s lot of reasons why it doesn’t address the real situation.

One is about time.Super is meant to last a lifetime, guide you through life’s ups and downs and deliver you a benefit over 40 or so years of work.

If you do let the figures run you’ll see that five years in super is but the twinkling of an eye and the long term delivers a different reality.

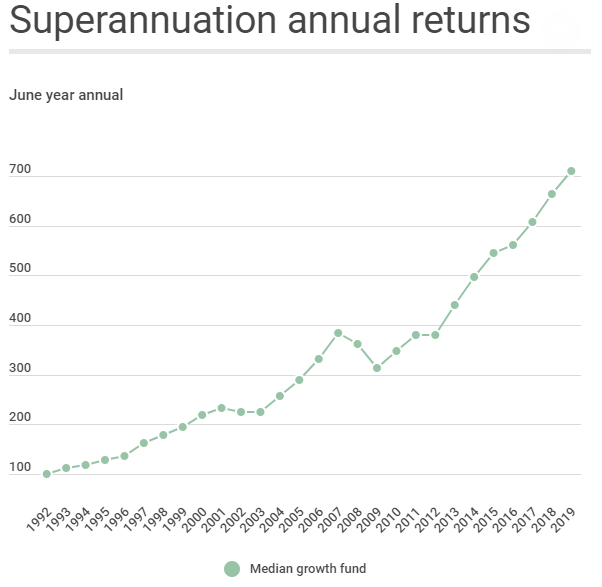

If you stuck a wad of cash in the stockmarket back in 1992, when the compulsory super system started, it would have increased 455.65 per cent by now.

If you add a generous four per cent annual accumulation for dividends reinvested then that translates into another 199.9 per cent gain for a total return of 655.5 per cent on your money.

Now if you compare that to the average return achieved by the median growth or balanced superannuation account, where most Australian super fund members are invested, you find something interesting.

Using the return figures calculated by consultancy Chant West you find that a wad of superannuation cash invested back in 1992 would have grown by a massive 709.9 per cent.

That is significantly above the return you would have gained on the stockmarket, and it would have delivered you far less heart-stopping moments along the way.

That’s because the elastic band that is the stockmarket is not reflected in the value of a balanced super account.

Chant West ran the numbers on two recent downturns, the global financial crisis and the slump late last year and found super funds fell by only about half the share market loss in the GFC and in late 2018.

The key to successful investing for super funds is diversification.

The key to successful investing for super funds is diversification.“Funds invest in diverse options that perform differently in the short term, the medium term and the long term to things like listed shares,” said Matt Linden, deputy CEO of Industry Super Australia.

The average balanced fund investment makeup for market leader AustralianSuper looks like this: Total shares are only 55 per cent of the asset base.

The rest of the portfolio includes infrastructure, direct property, loans to companies, fixed interest and cash.

That balance means that when shares fall, super fund values don’t fall by nearly as much.

And stopping those big falls is crucial to protecting super balances as it is harder to make ground on the way up than it is to lose it on the way down.

“If you lose 25 per cent it means your investments have to rise 33 per cent to win back that ground,” said Mano Mohankumar, researcher with Chant West.

The protection of diversification is why super funds were less damaged by the GFC than shares.

There is another factor that must be added into the return equation for the sharemarket.

“You can’t buy the stockmarket without paying fees to someone; someone has to buy it and look after it,” said independent economist Stephen Koukoulas.

“Especially if you were paying in monthly or quarterly instalments like superannuation, the brokerage costs would be very high.”

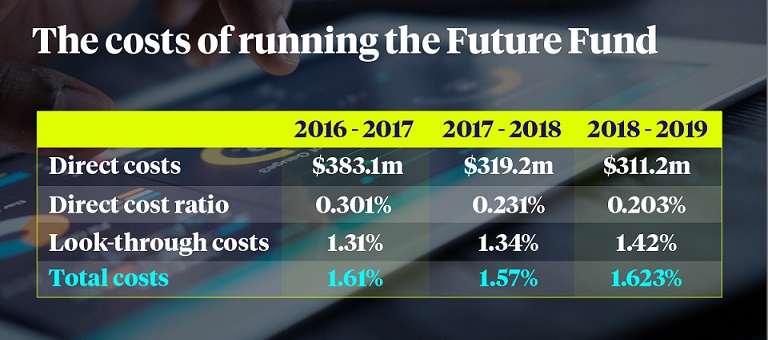

The Commonwealth’s Future Fund runs up annual charges of 1.623 per cent to shepherd its $166 billion under management and any comparison with the performance of the ASX would have to factor that in.

The Future Fund has only one shareholder to report to.But super funds must manage millions of accounts, so the costs of that would also have to be added to any notional comparison with ASX returns.

There is also tax, which neither the Future Fund nor notional stockmarket returns need to worry about.

But super members in accumulation phase pay 15 per cent tax on returns inside their accounts and that too would also have to be added in when making a comparison with the ASX.

Given all that, super funds have performed very well for Australians since compulsory superannuation became a reality back in 1992.

https://thenewdaily.com.au/finance/superannuation/2019/12/16/why-super-outdoes-shares/